The Essence of Estate Planning

The term “estate planning” might conjure images of vast wealth and financial intricacies for some. However, its core significance lies in offering peace of mind to individuals from all walks of life. This guide aims to illuminate the importance of estate planning, emphasizing its role in securing one’s legacy and ensuring the well-being of their loved ones.

Understanding Estate Planning

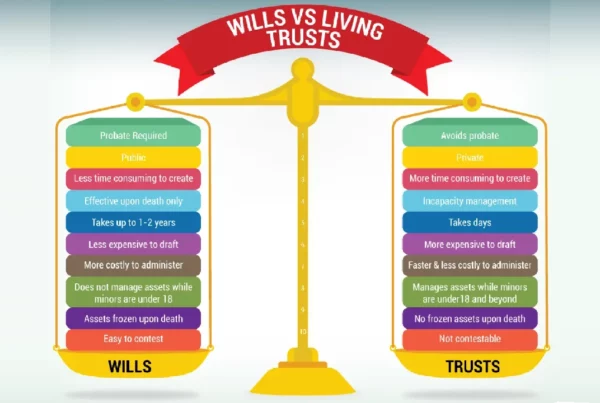

At its heart, estate planning is a strategic process that determines how your assets will be distributed and who will manage your responsibilities if you are unable to do so due to death or incapacitation. Your estate includes everything you own, from real estate and bank accounts to stocks and personal belongings. Through legal tools such as wills and trusts, estate planning ensures your directives are followed.

Key Benefits of Estate Planning

The rationale behind estate planning extends beyond mere asset distribution. It’s about granting you the authority to decide the allocation of your assets, protecting your loved ones from the complexities of the probate process, and possibly minimizing taxes and legal fees. Moreover, it allows you to specify your preferences for decision-making in scenarios where you might be incapacitated.

Who Needs Estate Planning?

Dispelling the myth that estate planning is only for the wealthy is crucial. Whether you are starting a family, buying a home, or stepping into retirement, an estate plan is essential. It is designed for anyone who wishes to clarify their intentions and lessen the burden on their loved ones.

Common Estate Planning Mistakes

The most significant oversight is not having an estate plan at all, which often results in the state determining the distribution of your assets. Other frequent mistakes include not keeping the plan updated, selecting an inappropriate executor, and overlooking the importance of establishing powers of attorney.

How to Get Started with Estate Planning

Begin your estate planning process by compiling a detailed list of your assets and liabilities. Reflect on your family dynamics and how you wish your estate to be managed, and engage in transparent discussions with your family members about your intentions. Following this, seek the advice of a professional to ensure that your estate plan is comprehensive and legally sound.

Estate Planning and the Law

Estate laws vary significantly across states and can have a profound impact on your estate, especially in terms of taxes and the probate process. Utilizing strategies such as trusts can help bypass probate and facilitate a smoother transition of assets, highlighting the importance of a solid understanding of these laws. It is best to consult with a local estate planning professional for more specifics on your states laws.

Learn from Other’s Stories

The contrast between a family who successfully avoided probate and minimized taxes through thorough estate planning and those who faced legal disputes due to unclear instructions underscores the necessity for meticulous planning. Learn more from these real-life examples and how they serve as a compelling testament to the importance of a well-constructed estate plan.

Conclusion: Empowering Your Legacy

Estate planning may seem daunting, but it is a manageable and vital step toward securing your and your family’s future. With the right guidance and expert advice, you can create a plan that meets your specific needs and ensures the care of your loved ones. Estate planning is an act of foresight and consideration, offering clarity and peace of mind to both you and your family.

Take our FREE quiz and see what services are best for your unique situation or schedule a consultation today to begin the journey toward protecting your legacy and ensuring your family’s future well-being.