Estate planning is an essential step in managing your assets and ensuring your wishes are honored in the event of your death or incapacitation. It encompasses various components, including wills, trusts, powers of attorney, and healthcare directives. With the growing availability of online tools and resources, many individuals wonder whether they need an attorney to create an estate plan. This article will explore the benefits of professional legal advice in estate planning and situations where an attorney might not be necessary.

The Value of Professional Legal Guidance:

- Complex Family or Financial Situations: If your family dynamics or financial situation is complex—such as having children from previous marriages, owning a business, or possessing substantial assets in multiple states—an attorney can provide tailored advice to ensure your estate plan addresses these complexities effectively.

- State-Specific Laws: Estate planning laws vary significantly by state, and what works in one state might not be valid in another. An experienced estate planning attorney will be familiar with your state’s laws and can help you navigate these legal intricacies, ensuring your estate plan is valid and enforceable.

- Reducing Estate Taxes: For individuals with larger estates, an attorney can suggest strategies to minimize estate taxes, potentially saving your beneficiaries a significant amount of money. This could involve setting up trusts or other estate planning tools that are best handled by professionals.

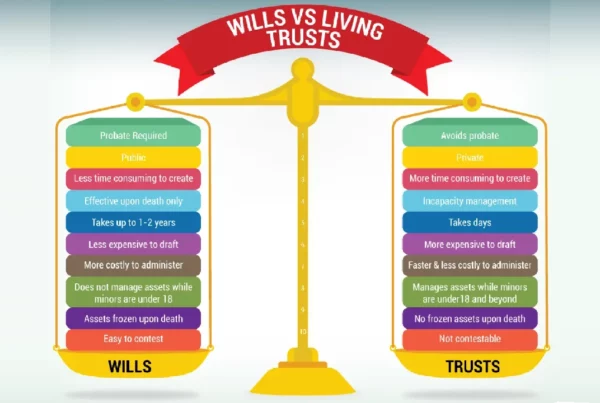

- Avoiding Probate: Probate can be a lengthy and costly process. An attorney can help you understand how to structure your estate plan to minimize the assets going through probate, ensuring a smoother and faster transfer of assets to your beneficiaries.

When Might You Not Need an Attorney?

- Simple Estates: If you have a straightforward financial situation, few assets, and your estate planning needs are basic, you might be able to use online tools or templates to create your will or other estate planning documents. However, it’s still wise to have a professional review your documents.

- Educational Purposes: Gathering information and educating yourself about estate planning is beneficial and can be done without an attorney. However, when it comes time to implement your plan, professional advice can help avoid mistakes.

The Final Verdict

While some individuals might feel comfortable creating an estate plan on their own, especially in simpler cases, consulting with an estate planning attorney is generally advisable to ensure your estate plan is comprehensive, valid, and tailored to your specific needs. An attorney can provide peace of mind by ensuring your estate plan effectively manages your assets and honors your wishes.

Before deciding, consider your personal situation carefully. If your estate is simple and your goals are straightforward, online tools or software might suffice. But for those with more complex needs or who want the assurance that comes with professional advice, hiring an attorney is a wise investment in your and your family’s future.

Remember, estate planning is not a one-size-fits-all process. Each individual’s situation is unique, and what works for one person may not be the best approach for another. Consulting with a professional can help clarify your estate planning needs and ensure your plan is executed as intended.

And as always, consider seeking personalized advice from a qualified attorney to address your specific estate planning concerns.